How to download year end reports for your transactions?

Reconciling crypto transactions used to be a mess. We decided to step in and start cleaning up that mess. DeFi Tax Calc enables every accountant, and crypto user to regain control over their crypto transactions.

However, to keep things organized, we’ve listed down some quick steps to obtain the year-end transaction report from every platform that we currently support.

Please note that currently we support year end gains reporting for only FY 2021-22.

Binance

- Log in to your Binance Australia account and click [Wallet] – [Fiat and Spot].

- Click [Transaction History]

- Click [Generate all statements]

- Select the range (1 July 2021 – 30 June 2022), account (All), and coin (All), then click [Generate].

- After the statement is generated, you will receive an SMS or email reminder.

- Now go to [Transaction History] – [Generate all statements]. Click [Download] next to the statement generated.

- Please note that the statement download link will only be stored for 7 days. Please download it as soon as possible.

Binance has also listed down these steps on their own website

https://www.binance.com/en-AU/support/faq/990afa0a0a9341f78e7a9298a9575163

Coinspot

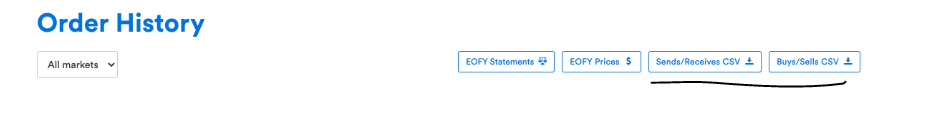

The required year-end transaction report can be found on the top right of the Order History page.

Independent Reserve

All other exchanges

- Download the custom_import – standard file

- Copy paste your data into the excel sheet

- Manually add in any other transactions from those far-flung exchanges which don’t provide any useful reports

- Upload the excel file in the ‘others’ section on the Reports page on defitaxcalc.io

Feeling lost?

Too many reports, too many transactions, too much to do?

Feeling lost? Or the new platform is just a bit too… new? We get it! We are always happy to help and make crypto reconciliation as easy as possible.

Give us a shout here.